SVB & Sovos ShipCompliant just dropped their annual State of the Wine Industry & DtC Wine Shipping reports this week. TLDR? This is what you need to know.

2021 was another wild year for wine. From weather events to labor shortages and continued shifting of consumer preferences and buying behaviors, there’s a lot to consume (pun intended). We realize that not everyone is as excited about wine analyses and data as we are… these reports are lengthy, and we read them so you don’t have to. Here are our top ten trends for 2021’s year of US wine in review:

# 10 – US wine consumption continues to grow in terms of dollars. Unsurprisingly, more and more wine sales move online.

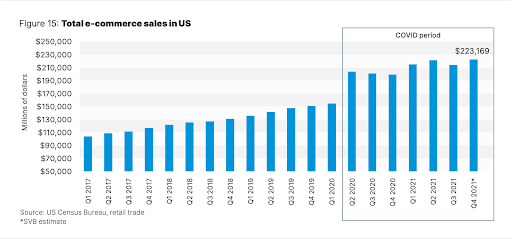

US consumer spending on domestic wine totaled $46.4 billion in the 12 months ended January 2021, and grew over 10% to $51.2 billion to close out 2021 (per Wines Vines Analytics). While in 2020, total digital sales in the US were up over 31%, to $760 billion, Q3 2021 eCommerce increased 6.6% over the Q3 of 2020, according to SVB. This means that full-year e-commerce retail sales in 2021 should end up 25% higher than the record sales in 2020, reflecting a massive difference in the way consumers are continuing to shop. Note that this volume covers all flavors of “online” including 3-Tier online ordering from retailers and “eTailers” (such as Total Wine, Vivino, wine.com) and winery eCommerce DTC.

# 9 – Demand is growing disproportionately for premium wine.

Consumers who drink wine continue to show that they prefer drinking better but less wine. Since 2013 there’s been a consistent shift in consumer demand away from value wine < $9 in favor of > $9 wine. In eCommerce DTC, average price per bottle shipped in 2021 jumped a record 11.8% to $41.16 over 2020’s $36.83 average bottle price.

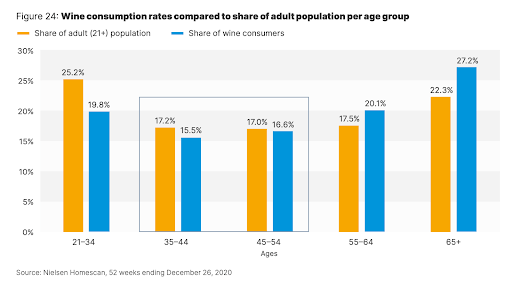

# 8 – Wine is losing out to other alcoholic beverage categories for the US’ younger drinking age generations.

There are a number of underlying reasons for the shift. In particular, the clear shift in preferences between Millennials & Gen Y and Boomers & Gen X – to which most wineries are still exclusively targeting marketing efforts. Millennials and Gen Y have different values, less discretionary income, are less traditional (i.e. more experimental), value transparency and sustainability, and are more health conscious than older generations (to name a few). This means that brands need to evolve messaging to resonate with younger generations. As compared to craft beer and spirits brands, wine is missing the mark in messaging to the youngest drinking-age consumers, and it’s not long before Gen X consumer base hit fixed incomes, and Boomers are no longer consuming wine.

# 7 – The digital divide is growing between wineries which have invested and those which have not.

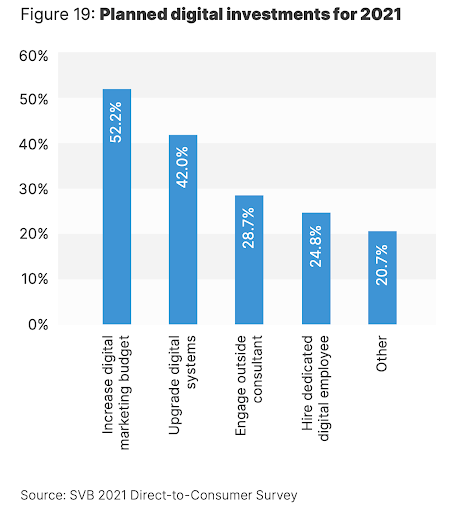

The US market for wine overall is not poised for sustained growth due to a handful of converging trends. Some wineries will be successful while others who fail to act fast enough are likely to face consolidation. Investing in digital isn’t just adding eCommerce to your website; the bar for user experience in discovery, research and ordering required by consumers is set by Amazon, Etsy and Instagram/TikTok – not the wine industry. The wine industry needs to keep pace. To quote SVB directly, “The growth opportunity for tomorrow isn’t going to come by waiting the pandemic out and hoping we return to pre- pandemic business conditions, switching to by-appointment tastings, planning club events, refining your hospitality training or, for that matter, delivering better hospitality. Those are good ideas for most wineries to consider, but the best solution for almost all wineries is increased attention to and investment in the multitude of digital opportunities in data, streaming and e-commerce. Examples include:

- Getting digital exposure to new consumers who live elsewhere and don’t know you.

- Finding ways to encourage those consumers to join your wine club via digital means instead of insisting that the only method for club growth is tasting room visitation.

- Building your brand regionally by offering experiences away from the winery, including a digital component. Zoom is just one tool for that.

- Investing in understanding your existing consumer data.”

Of wineries SVB surveyed, here’s where they said they intend to invest in digital in 2021.

# 6 – The industry has reached the point in its lifecycle where there’s a compelling case for thoughtful organization around a collective marketing campaign, for the wine category overall.

Over the last four years, wine trails beer and spirits in annual media spending by an average of $1.1B and $340M respectively. Meanwhile, as noted in #8 above, data indicates that wine is losing relevance to legal drinking-age consumers. Many wine producers are already operating in a way that would drive a high perception of value by younger generations, if only they would get better at sharing the message with consumers, (e.g. buy local, sustainability practices, calorie content, etc.). Led by four industry leaders, momentum is building for a research and promotion movement with the help of USDA to course-correct the trend, use messaging that resonates with beverage consumers, and ultimately to keep wine in front of mind for US consumer “drinking occasions”. The org’s singular objective is simple: to grow demand for wine in the US marketplace. More information can be found at https://wineramp.org/.

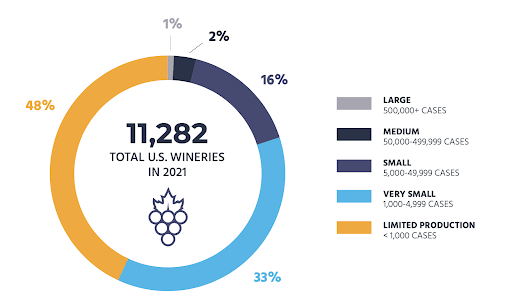

# 5 – Growth in the number of new wineries slowed during 2021, but did not stop.

There are 11,282 US wineries as of Jan 2022, 487 of which are in Texas, the 4th largest number of wineries per state. Overwhelmingly, the largest number of wineries are in the state of California (43%), with Washington (8%), Oregon (8%), and New York (4%) rounding out the top five. Wineries have been growing at an average of 5% YoY for the last decade, although 2021 growth was just under 2% per Wines Vines Analytics.

# 4 – The wine industry was not immune to the supply chain challenges, labor shortages and climate change experienced by everyone, everywhere.

No surprises here, but a noteworthy callout nonetheless. Impacts were most acute in glass materials, and tasting room staff. And weather events from fires to late frosts left geographies with notable shortages on wine grape yield, as compared to forecast.

# 3 – Winery channels are shifting, and 3-Tier Off Premise was the biggest loser in 2021.

As compared to 2020, wholesale off-premise declined from 18.4% to 10.6% of surveyed wineries’ total sales for 2021. At the same time, wholesale on-premise (i.e. tasting room) sales regained some ground, growing to 19.2% from 10.8% in 2020. This isn’t too surprising, given the Covid-19 tasting room closures in 2020. The part that is a little surprising, however, is that online sales remained strong, dropping only slightly from 9.8% to 9.1% year-over-year. A nice segway to…

# 2 – Covid-19 wasn’t a temporary shock to the system as it relates to Direct to Consumer (DTC) eCommerce. DTC eCommerce continues to climb in both pure dollars, and as a percentage of total.

Over 2021 DTC eCommerce was one of the biggest channel “winners” and did not reverse the explosive growth we witnessed in 2020 when the world and restaurants, wineries and physical wine shops opened back up. Notably, new 2020 DTC online wine buyers largely stayed active in 2021, providing a significant boost to winery shipments over the year. According to historical Sovos ShipCompliant customer data, nearly the same number of new 2020 buyers remained in the channel in 2021 as new buyers in past years have. This helps account for the increase in volume in 2021 even when the number of new buyers was reduced from 2020.

# 1 – Online Wine DTC has some serious scale, shattering $4B in 2021, and poised for further growth in years to come.

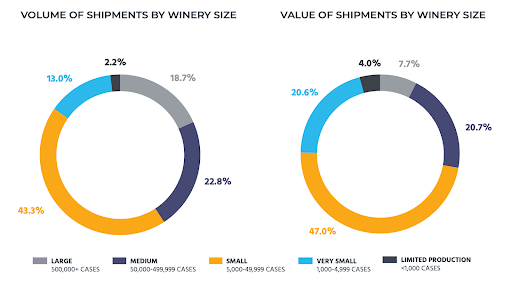

Younger consumers may be leading the pack in terms of leaning into digital discovery, but it turns out everyone prefers the convenience of both 1) online shopping, and 2) wine delivery to our doorsteps. 2021 DTC eCommerce came in at $4.2B for the year, up from $3.7B in 2020, and at a total volume 8.5 million cases. This channel is poised for sustained growth, at almost 8% of total US wine consumption. Wineries classified as “small”, “very small” and”limited production” represent over 70% of the value in this rapidly growing channel. This further underscores its importance going forward, as these cohorts make up 97% of the population of US wineries as of Q1 2022.

Did this quick summary leave you wanting more? Be sure to subscribe directly with Silicon Valley Bank (SVB) and Sovos ShipCompliant to get access to their 2022 industry reports, and the latest industry data at Wines Vines Analytics.